Current Trend in Nickel Alloy Scrap Prices

The price of nickel alloys scrap is intrinsically linked to the global price of nickel. Nickel is a key component in these alloys, and any fluctuations in its price can significantly impact the cost of scrap. The nickel market is facing a massive supply glut this year as surging Indonesian production continues to outpace global demand.

At the LME, the canceled warrants ratio has remained consistently within the range of 2-3%, signaling minimal activity in LME warehouse inventories. Given the anticipation of a slowdown in the economies of the US, China, and Europe over the next 1-2 months, we do not foresee any upward momentum in nickel alloy scrap prices.

With respect to nickel demand and supply, the International Nickel Study Group (INSG) predicts a surplus of 239,000 tonnes, marking the largest surplus in at least a decade and a notable increase compared to the previous year’s excess of 105,000 tonnes. This projection also reflects an upward revision from INSG’s 2022 assessment, where they had anticipated a surplus of 171,000 tonnes for 2023 year.

Several factors affect the price of nickel, including:

The Impact on Nickel Alloys Scrap Prices

Given the close connection between nickel prices and nickel alloys scrap prices, businesses involved in buying and selling these materials should closely monitor the factors mentioned above. When nickel prices rise, the value of scrap materials containing nickel, such as Inconel, Monel, Hastelloy, and Incoloy, tends to increase. Conversely, when nickel prices fall, the value of these scrap materials may decline.

Adapting to Market Conditions

To navigate the changing tides of nickel alloys scrap prices, businesses can consider the following strategies:

- Market Analysis: Stay informed about global nickel market trends, supply and demand dynamics, and geopolitical events that could impact prices.

- Diversification: Diversify your portfolio of nickel alloys scrap to include a range of grades. Some alloys may be more resilient to price fluctuations than others, depending on their composition and demand in specific industries.

- Efficiency and Cost Reduction: Explore ways to improve operational efficiency and reduce costs in your scrap processing and recycling operations.

- Hedging: Consider hedging strategies, such as futures contracts or options, to protect against adverse price movements.

- Long-Term Contracts: Establish long-term contracts with suppliers and buyers to provide stability in pricing and supply.

Conclusion

The direction in prices for nickel alloys scrap is closely tied to the global nickel market and influenced by a complex interplay of factors. To thrive in this competitive industry, businesses must be vigilant, adaptable, and well-informed. By monitoring global nickel trends, diversifying their product range, and implementing sound business strategies, companies can navigate the currents of nickel alloys scrap pricing and position themselves for success in this dynamic market.

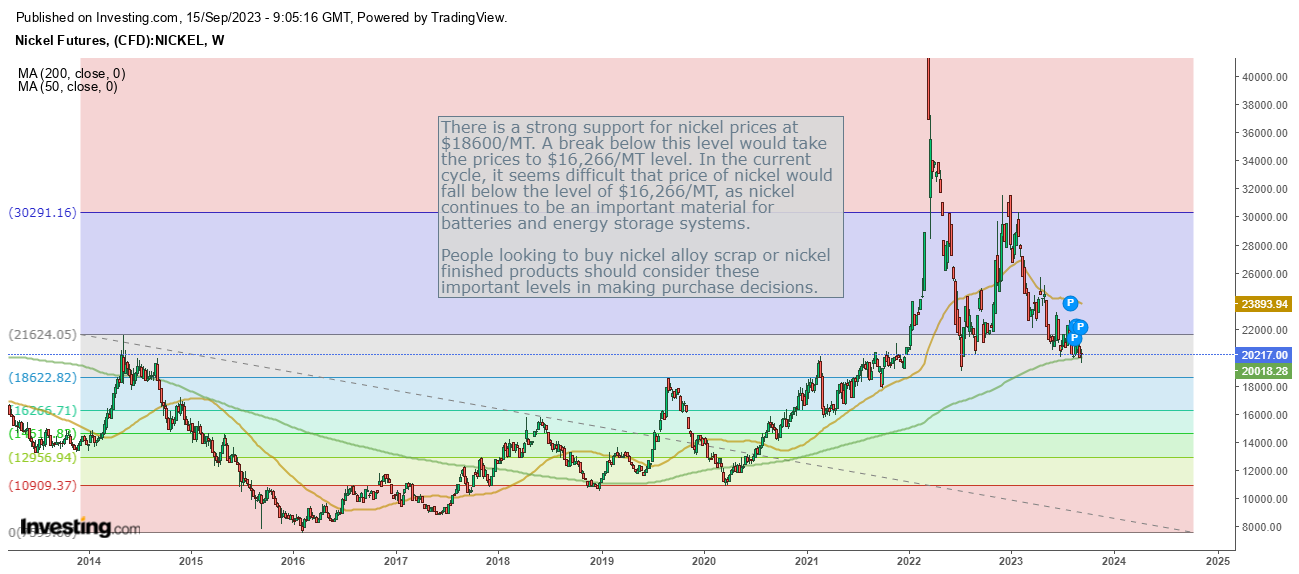

There is a strong support for nickel prices at $18600/MT. A break below this level would take the prices to $16,266/MT level. In the current cycle, it seems difficult that price of nickel would fall below the level of $16,266/MT, as nickel continues to be an important material for batteries and energy storage systems.

People looking to buy nickel alloy scrap or nickel finished products should consider these important levels in making purchase decisions.